The Complete Guide to Bikepacking for Beginners and Weekend Adventurers

So, you’ve seen those photos. A bike leaning against a lone pine, dusty bags strapped to its frame, a camp stove simmering as the sun...

The Intersection of Automotive Cybersecurity, Software Updates, and Modern Repair

Think about the last time your phone needed an update. You tapped "install," maybe grumbled about the wait, and carried on. Now, imagine that process,...

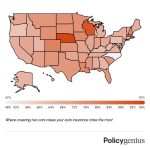

Car Rental Insurance Alternatives: Your Guide to Third-Party Coverage

You’re at the rental counter, keys almost in hand. Then the agent starts the insurance spiel. It’s a blur of acronyms—LDW, CDW, SLI—and the daily...

Navigating Auto Loan Refinancing in a High or Volatile Interest Rate Environment

Let's be honest—the financial landscape feels like a rollercoaster lately. One minute rates are climbing, the next they're dipping, and you're left wondering if now...

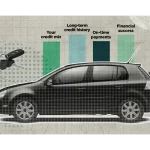

Auto Loan

Navigating Auto Loan Refinancing in a High or Volatile Interest Rate Environment

Let's be honest—the financial landscape feels like a rollercoaster lately....

The Real Cost of the Click: How Rising Interest Rates Are Squeezing Auto Loan Affordability

You've probably felt it. That subtle, persistent pinch every time...

How to Negotiate Auto Loan Terms: Your Playbook for Dealerships and Lenders

Let's be honest. Walking into a car dealership or clicking...

How Credit Unions Actually Compete With Banks for Auto Loan Rates

You're staring at the dealership's financing offer. The rate isn't...

Best Auto Loan Providers of 2025: A Comprehensive Review

Let’s be honest—buying a car is exciting, but financing it?...

Auto

Car

The Future of In-Car Biometrics: Your Health and Security on the Road

Imagine your car knowing you're too stressed to merge onto the highway before you do. Or, it preventing a theft...

Top Tips for First-Time Used Car Buyers in Florida

Buying your first used car can be both exciting and overwhelming. For first-time buyers in Florida, the process involves careful planning, research, and knowing what...

Digital Nomad Vehicle Setup for Remote Work: Your Office on the Open Road

Let's be honest. The dream of working from a beach is alluring, but the reality often involves sun glare on your laptop and sand in...

Sustainable Car Modifications for the Eco-Conscious Driver

Let's be honest. If you're truly eco-conscious, the greenest car is no car at all. But for most of us, that's just not the reality....

A Deep Dive Into the Unique Design Features of the Nissan Ariya Nismo 2025

Nissan engineers opted to distribute power more evenly among both motors for increased handling agility and greater road fun. Their engineers tuned this system so...

Bike

The Complete Guide to Bikepacking for Beginners and Weekend Adventurers

So, you’ve seen those photos. A bike leaning against a lone pine, dusty bags strapped to its frame, a camp...

The Rise of Adaptive and Inclusive Cycling: Freedom on Two (or Three, or Four) Wheels

For a long time, the simple joy of a bike ride felt like a closed road for many people with...

Building a Bike-Centric Community: From Social Rides to Advocacy and Local Infrastructure Projects

You know that feeling. The wind in your face, the quiet hum of tires on pavement, the simple joy of...

E-bike Conversion Kits for Vintage Bicycle Models: Breathe New Life into Your Classic Ride

That old Schwinn leaning against the garage wall. The classic Peugeot you can't bear to part with. They're full of...

The Role of Bikes in Disaster Preparedness and Emergency Mobility

When disaster strikes—whether it’s a hurricane, earthquake, or power grid failure—roads clog with panicked drivers, fuel runs short, and emergency...

10 Futuristic Bike Designs We Can’t Wait to Ride

Bike design is constantly adjusting to remain relevant with technology and brand image trends. Some changes may involve making slight...

Car Insurance

Car Insurance for Gig Economy Drivers: The Rideshare and Delivery Coverage You Actually Need

Let's be honest. When you signed up to drive for Uber, Lyft, or DoorDash, you probably didn't spend hours thinking...

Auto Repair

The Intersection of Automotive Cybersecurity, Software Updates, and Modern Repair

Think about the last time your phone needed an update. You tapped "install," maybe grumbled about the wait, and carried...

Downtime Costs: Why Reactive Repairs Hurt Your Fleet’s Bottom Line

When you operate a commercial fleet in Denver, every minute your trucks are off the road costs you money. And...

Sustainable Auto Repair: A Greener Road for Your Car and the Planet

Let's be honest. When you think of auto repair, "eco-friendly" isn't usually the first phrase that comes to mind. You...

Electric Vehicle Maintenance and Repair Basics: Your No-Sweat Guide

So, you've made the leap to an electric vehicle. Good for you. The quiet hum, the instant torque, the never-stopping-at-a-gas-station-ever-again...

Top Reasons to Quickly Address Car Window Repairs

The Importance of Addressing Car Window Repairs Immediately Car window damages may initially seem minor inconveniences, but postponing repairs can...

The Benefits of Paint Protection Film for Your Vehicle

Key Takeaways: Paint Protection Film (PPF) protects against scratches, rock chips, and minor abrasions. PPF enhances the aesthetic appeal of...

Categories

Latest News

The Complete Guide to Bikepacking for Beginners and Weekend Adventurers

The Complete Guide to Bikepacking for Beginners and Weekend Adventurers The Intersection of Automotive Cybersecurity, Software Updates, and Modern Repair

The Intersection of Automotive Cybersecurity, Software Updates, and Modern Repair Car Rental Insurance Alternatives: Your Guide to Third-Party Coverage

Car Rental Insurance Alternatives: Your Guide to Third-Party Coverage Navigating Auto Loan Refinancing in a High or Volatile Interest Rate Environment

Navigating Auto Loan Refinancing in a High or Volatile Interest Rate Environment- The Future of In-Car Biometrics: Your Health and Security on the Road