How to Negotiate Auto Loan Terms: Your Playbook for Dealerships and Lenders

Let’s be honest. Walking into a car dealership or clicking on a loan application can feel like stepping into an arena. The numbers swirl—APR, term length, down payment—and it’s easy to feel like you’re just along for the ride. But here’s the deal: your auto loan is not a take-it-or-leave-it proposition. It’s a negotiation. And with the right preparation, you can drive off with a deal that saves you thousands.

The Golden Rule: Separate the Car from the Loan

This is your most powerful move. The moment you start talking monthly payments with a salesperson, you’ve tangled two huge negotiations into one messy knot. Instead, negotiate the price of the vehicle first, as if you were paying cash. Get that final, out-the-door number in writing. Only then should you even begin discussing financing. This keeps the dealer from, you know, hiding a higher car cost in a confusing loan package.

Your Pre-Negotiation Homework (Don’t Skip This)

Walking in unprepared is the fastest way to lose. Think of this as your financial armor.

- Know Your Credit Score: This is your leverage. Check it for free through your bank or a reputable service. A score above 720 gets you the best rates; knowing where you stand prevents a lender from telling a… creative story about your credit.

- Get Pre-Approved: This is your secret weapon. Apply for an auto loan with your bank, credit union, or an online lender before you shop. That pre-approval letter is a concrete bargaining chip—it shows the dealer you have options and know what rate you deserve.

- Understand the Lingo: APR (Annual Percentage Rate) is the true cost of the loan, including fees. The loan term is how long you’ll pay. A longer term means lower monthly payments but way more interest paid overall. It’s a trade-off.

- Run the Numbers: Use an online auto loan calculator. Plug in different loan amounts, APRs, and terms. See how a 0.5% rate drop or a $1,000 larger down payment affects the total cost. It’s eye-opening.

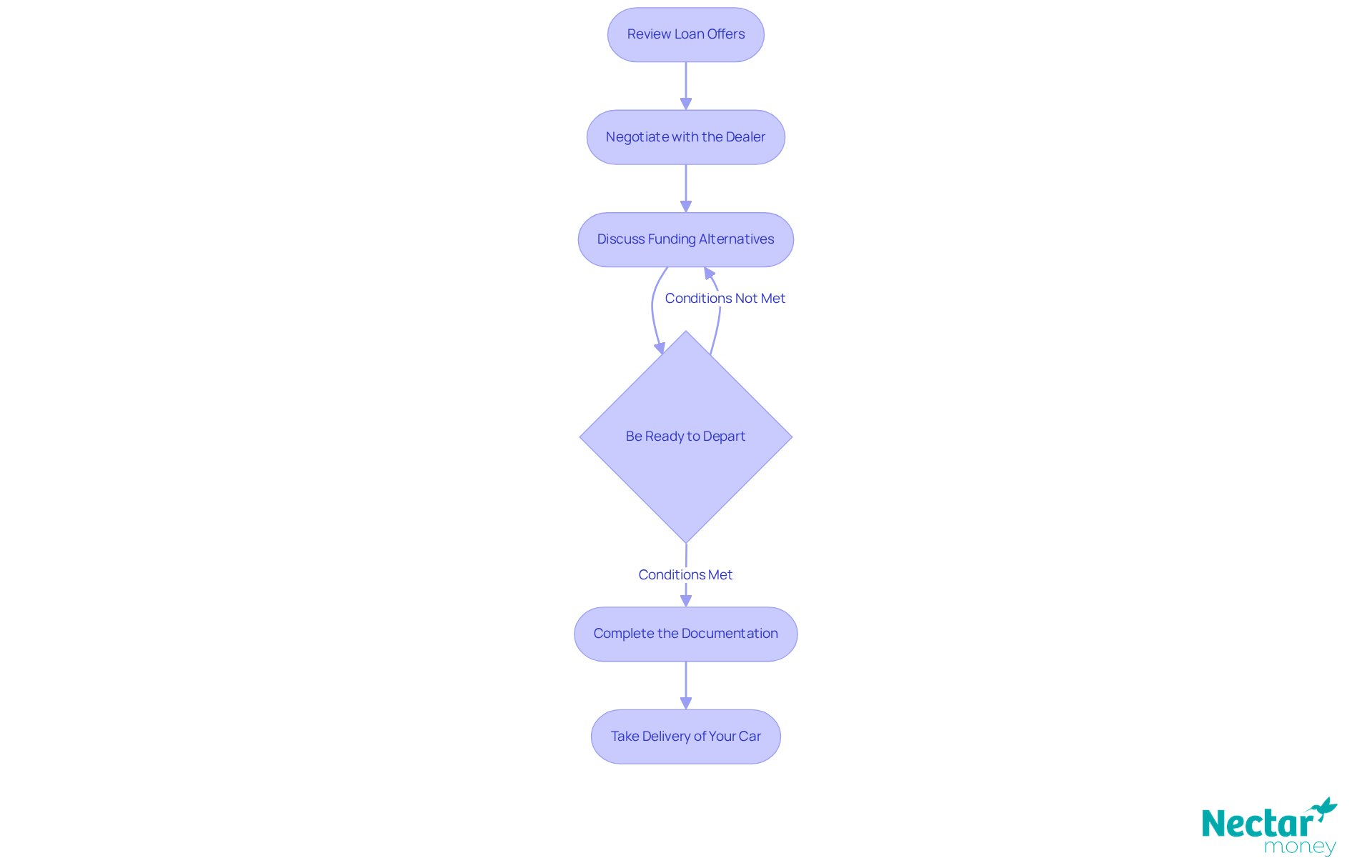

The Negotiation Play-by-Play

At the Dealership: Navigating the Finance & Insurance (F&I) Office

You’ve agreed on a car price. Now you’re in the small office with the finance manager. This is where the real financial negotiation happens.

1. Start with Your Terms: Don’t ask, “What can you offer me?” Instead, lead. “I’m pre-approved at 5.5% for 60 months. If you can beat that rate, I’m happy to finance with you.” This flips the script.

2. Focus on the APR, Not the Monthly Payment: They’ll want to talk monthly payment. Politely steer them back to the interest rate. A lower payment spread over 84 months is a terrible deal. Say something like, “Let’s settle on the APR first, then we can see what the payment looks like.”

3. The “Add-On” Ambush: You’ll be presented with extended warranties, paint protection, gap insurance. Some have value; most are pure profit. Listen, then ask for the menu of prices. Say you need to think about them—you can often add them later if you truly want. Don’t get pressured into signing for them on the spot.

4. Read Every. Single. Line. Before you sign, review the contract thoroughly. Ensure the negotiated price, APR, loan term, and any agreed-upon items are correct. No surprises.

With Direct Lenders: A Different Game

Negotiating with a bank or online lender feels different—it’s often done via phone or chat. But you still have room to maneuver.

1. Shop Your Rate: Get offers from at least three lenders. Use them as leverage. “I have an offer for 6.2% from [Other Lender]. Is there anything you can do to improve your offer?”

2. Ask About Fee Waivers: Inquire about application or origination fees. Sometimes, they can be reduced or waived, especially if you’re a strong customer.

3. Consider Relationship Discounts: If you’re getting a loan from a bank where you have accounts, ask: “Do you offer any loyalty discounts for existing customers?” You’d be surprised how often the answer is yes.

Advanced Tactics & Common Pitfalls

Okay, so you’ve got the basics down. Let’s get a bit tactical. A common pain point right now is high interest rates. It makes these moves even more critical.

The Down Payment Leverage: A larger down payment isn’t just good for your loan-to-value ratio; it’s a negotiation tool. Offering 15-20% down shows you’re serious and low-risk, which can help you argue for a better rate.

Term Length: The Double-Edged Sword: Sure, a 72 or 84-month loan makes the payment palatable. But you’re paying so much more in interest, and you’ll likely be “upside-down” (owing more than the car’s worth) for years. Aim for the shortest term you can comfortably afford. 60 months is often a sweet spot.

The “Special Financing” Trap: 0% APR offers? They’re great—if you have impeccable credit. And they often mean forfeiting cash rebates. Do the math: sometimes taking the rebate and a low-rate loan is better.

And one more thing—don’t get emotionally attached to the car until the loan is signed. Be willing to walk away. That power is everything.

Your Negotiation Cheat Sheet

| What to Negotiate | How to Approach It | Goal |

| Interest Rate (APR) | Use pre-approval as a benchmark. Ask directly: “Can you beat this rate?” | Get the lowest possible APR for your credit tier. |

| Loan Term | Choose based on total cost, not just monthly payment. Resist ultra-long terms. | Balance affordable payment with minimal total interest. |

| Fees | Ask for a line-item breakdown. Question any “document” or “processing” fees. | Eliminate or reduce unnecessary add-on costs. |

| Down Payment | Use a larger down payment as leverage for a better rate. | Lower loan amount, better LTV, stronger negotiating position. |

Sealing the Deal (On Your Terms)

Negotiating an auto loan isn’t about being the loudest person in the room. It’s about being the most prepared. It’s a quiet confidence that comes from knowing your numbers, understanding the process, and remembering that you are the customer. They need your business.

So take a deep breath. Do your homework. Walk in with your pre-approval and your target numbers. And shift your mindset from hoping for a good deal to knowing how to structure one. The difference in your wallet—over the life of that loan—will be absolutely worth it.