Car Insurance for Gig Economy Drivers: The Rideshare and Delivery Coverage You Actually Need

Let’s be honest. When you signed up to drive for Uber, Lyft, or DoorDash, you probably didn’t spend hours thinking about your car insurance policy. You were thinking about flexibility, extra cash, and being your own boss. But here’s the deal: that personal auto policy sitting in your glove compartment? It likely has a massive, gig-shaped hole in it.

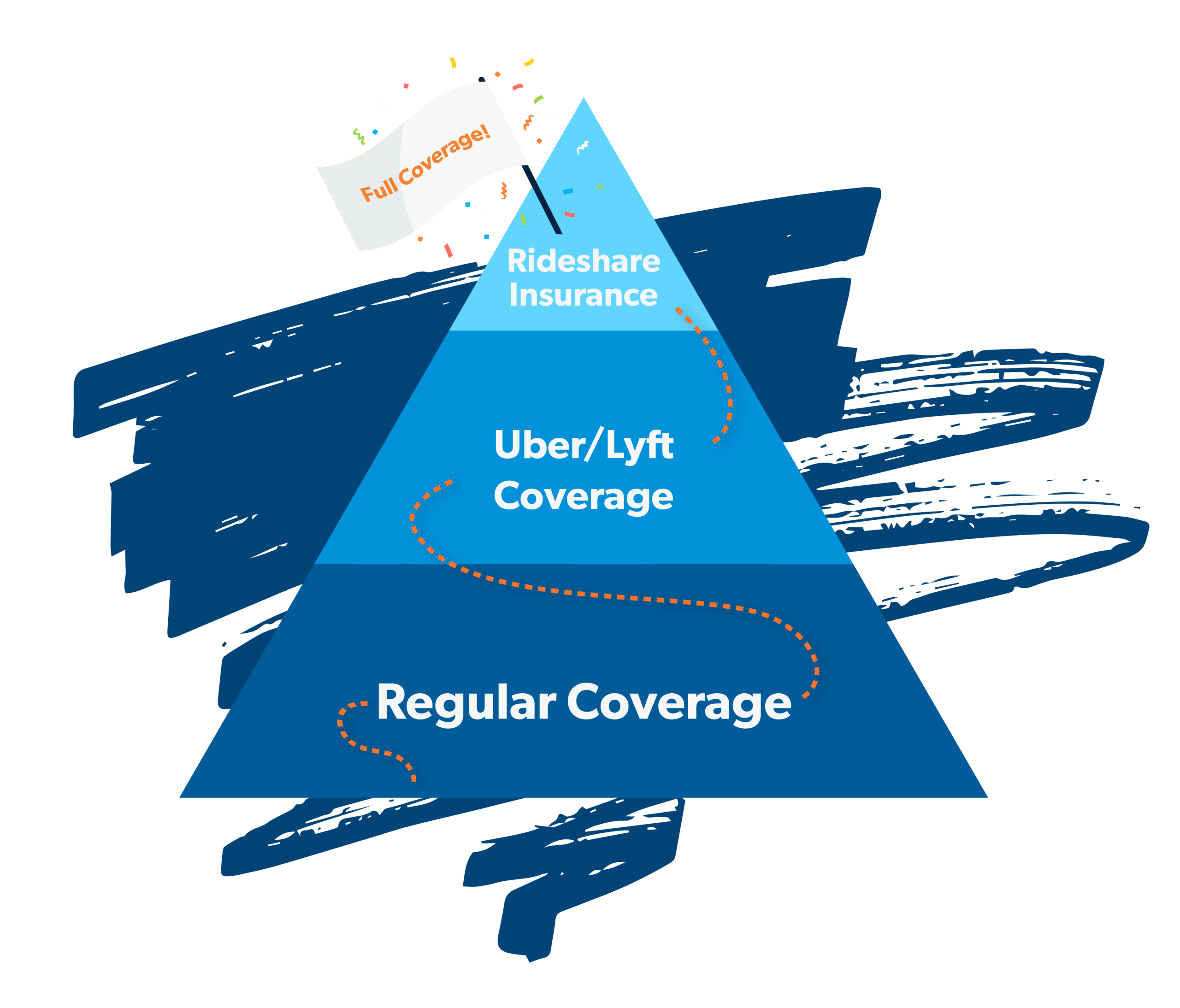

Driving for a living—even part-time—changes everything. And navigating the insurance gap between your personal policy and the company’s commercial coverage is the single most important, and confusing, part of the job. Let’s dive in and untangle it, so you’re never left financially exposed on the road.

The Three Phases of a Gig: Why Your Personal Insurance Isn’t Enough

Think of a rideshare or delivery trip like a play with three acts. Your insurance needs shift dramatically in each one, and most standard policies simply bow out after the first scene.

Phase 1: The App is Off (Personal Time)

You’re just running errands or commuting to your day job. Here, your personal auto insurance is in full effect. No surprises.

Phase 2: App On, Waiting for a Trip/Order (The Critical Gap)

This is the danger zone. You’re logged in, available, but haven’t accepted a ride or picked up a burrito yet. In most states, your personal insurer sees you as “engaged in a business activity” and may deny a claim entirely if you’re in an accident. Meanwhile, the gig company’s coverage is often minimal—maybe just liability, and sometimes with a high deductible.

Phase 3: En Route to Pickup and On-Trip (Platform Coverage)

Once you accept that ping and are actively working, the company’s commercial policy kicks in. It’s better, sure. But it often comes with limits that might not fully cover you or your car, especially for collision or comprehensive damage.

See the problem? Phase 2 is a massive insurance black hole. And honestly, you live in Phase 2 a lot. Sitting in a parking lot, waiting. That’s where specialized coverage comes in.

Your Coverage Toolkit: Rideshare Endorsements vs. Commercial Policies

Okay, so you need a bridge over that gap. You’ve got two main tools to build it, and choosing the right one depends on how deep you’re in the gig economy.

1. The Rideshare Endorsement (The Most Common Fix)

This is an add-on to your existing personal policy. For maybe $15-$30 a month, it extends your coverage to fill Phase 2. It’s seamless, relatively affordable, and a no-brainer for anyone driving part-time or even full-time for a single app. Most major insurers—Progressive, Geico, State Farm, Allstate—offer these now.

What it typically covers: It makes your personal collision and comprehensive coverage valid during Period 2. It also often adds contingent liability coverage that fills the gap until the company’s policy activates.

2. Commercial Auto Insurance (The Heavy-Duty Option)

This is a separate, standalone policy. It’s more expensive—think double or triple your personal rate—but it provides the broadest protection. It’s essential if you:

- Drive full-time, 40+ hours a week.

- Use a vehicle specifically purchased for gig work.

- Carry commercial goods (beyond food delivery) or passengers for multiple services.

- Want the highest possible liability limits without any gaps or “phases.”

A commercial policy treats you like a business from the moment you start your car, which can be a huge relief.

Delivery Drivers: Don’t Assume You’re Covered

Here’s a crucial point many delivery folks miss. That rideshare endorsement? Its name is misleading. It often excludes delivery for services like DoorDash, Instacart, or Grubhub unless it specifically states “delivery” or “livery” coverage.

You must, and I mean must, read the fine print or call your agent. Say the exact apps you use. “I deliver food for DoorDash and shop for Instacart.” Some insurers have specific “food delivery endorsements.” Others might force you to a commercial policy. It’s a mess, but assuming you’re covered is a recipe for disaster.

| Scenario | Personal Policy Only | With Rideshare/Delivery Endorsement | With Commercial Policy |

| Accident while app on, waiting | Claim likely DENIED | Covered under your policy’s terms | Covered as a business activity |

| Accident while delivering a pizza | Claim likely DENIED | Only if endorsement includes delivery | Covered |

| Theft of your car while you’re in a store picking up an order | Claim likely DENIED | Comprehensive coverage likely applies | Covered |

Practical Steps to Get Covered (Without the Headache)

Feeling overwhelmed? Don’t. Just follow this checklist.

- Call Your Current Insurer First. Ask: “Do you offer an endorsement for rideshare AND delivery driving?” Get a quote. Be specific about your apps.

- Shop Around. Not all endorsements are equal. Compare costs and, more importantly, the specific coverage triggers. Does it cover Period 2 liability at $50,000 or $100,000? What’s the deductible?

- Declare Your Mileage Accurately. Low-balling your annual mileage to get a lower rate is a classic way to get a claim denied. You’re driving more now. Be honest.

- Review the Gig Company’s Policy. Go into your driver app and find the insurance details. Know their deductibles and limits. Your goal is to cover what they don’t.

- Consider Gap Coverage. If the gig company’s policy has a $2,500 collision deductible, you might want extra coverage to bridge that, too.

The Real Cost of Getting It Wrong

It’s not just about a fender bender. Imagine a more serious accident during that waiting period. Without proper coverage, you could be personally sued for medical bills, lost wages, and pain and suffering of others. Your personal assets—your savings, even your home—could be on the line.

Or, your insurer could simply drop you for misrepresenting your car’s use. Finding new insurance after a non-renewal is expensive and difficult. That “savings” from skipping the endorsement vanishes in an instant.

The gig economy sells freedom. But true freedom on the road comes from knowing you’re protected, no matter what phase you’re in. It’s the foundation that lets you hustle with peace of mind. Because at the end of the day, your car isn’t just your car anymore—it’s your office, your inventory room, and your livelihood. Doesn’t it make sense to insure it that way?